It's Time to Measure how Customer Experience Impacts Revenue

by Dom Beveridge | Apr 13, 2021 12:00:00 AM

Last week I was curious to hear about some new research conducted by J Turner Research and RealPage, into the impact of online reputation on multifamily performance. It is, in my view, an area that has been crying out for research for some time: companies devote resources to tracking, managing and promoting resident reviews. It is helpful, therefore, to understand how it impacts the top line.

Last week I was curious to hear about some new research conducted by J Turner Research and RealPage, into the impact of online reputation on multifamily performance. It is, in my view, an area that has been crying out for research for some time: companies devote resources to tracking, managing and promoting resident reviews. It is helpful, therefore, to understand how it impacts the top line.

There is another reason for our interest in online reputation: it seems, at least intuitively, to be one of the more objective measures of customer experience. And in a multifamily industry that is embracing technologies that can radically improve prospect and customer experiences, we should be able to measure their impact on performance. Coincidentally, we had been pondering this very issue in a white paper about smart building technology that we released this week.

The impact of customer experience is notoriously difficult to quantify, especially in multifamily housing, where so many things contribute to resident satisfaction. But in the case of smart building technology, the quality of the experiences varies significantly, which creates a need to understand the relationship between the quality of the experience and revenue performance.

Previous research on the topic

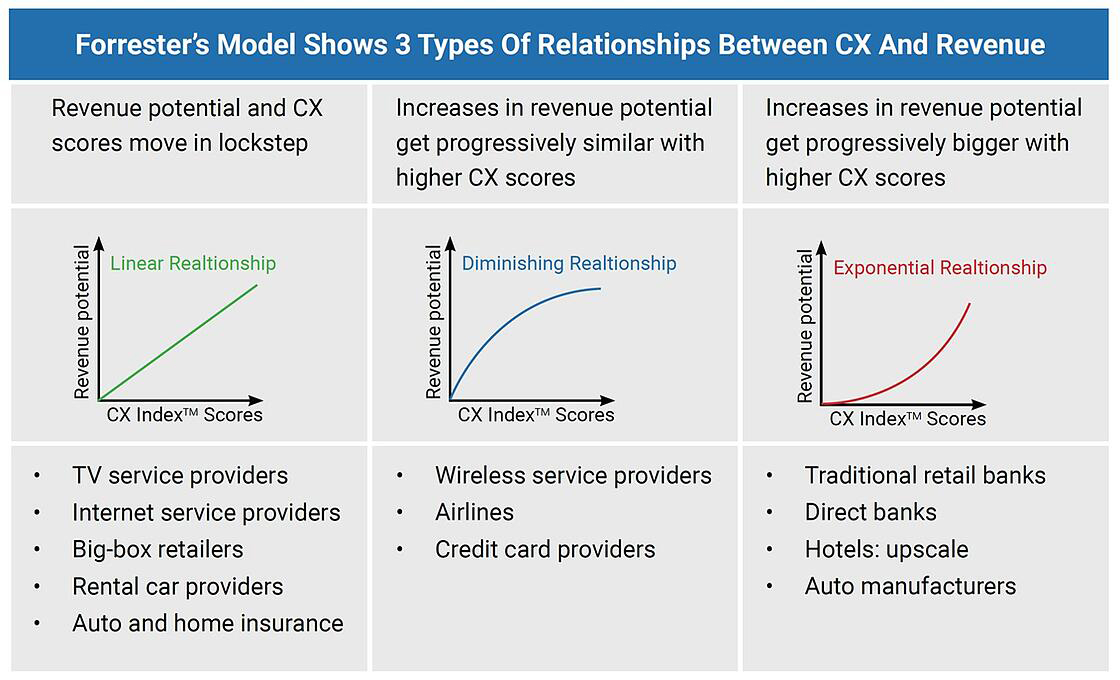

In their 2017 white paper, "Drive Revenue With Great Customer Experience," Forrester Research shared the findings of an analysis of the impact of customer experience in the industries that it serves. Its analysis model focused on the relationship between a customer experience index and revenue growth while accounting for four major variables that influence a company's revenue potential:

- Barriers to switching

- Relationship value

- Recommendation effectiveness (i.e., the opportunity for an existing customer to recommend to another potential customer)

- Enrichment opportunities (i.e., the opportunity to drive incremental purchases)

Multifamily operators or investors will be immediately familiar with the first two items. A resident's decision to move house is heavily influenced by external factors, and moving house is a pain. But the living experience impacts marginal decisions about whether or not to renew, and the level of renewal increase that the resident will pay. The relationship value is unusually high in multifamily, where purchase decisions typically come in the form of 12-month leases.

Historically multifamily would have viewed the impact of recommendations as marginal compared to other industries, online retail, for example. But the prominence of online reputation has elevated it to an important consideration for multifamily. The research, which involved 122,500 US adults, found that "advocacy potential" (where customers who have excellent experiences are likelier to recommend and to more people) gets progressively higher as customer experience scores increase.

Why it matters to multifamily

Although in the research Forrester does not study multifamily housing specifically, the segment of companies to which it fits most closely (the one that includes upscale hotels and auto manufacturers - see diagram) is the one whose revenue potential is the most positively impacted by improved customer experience.

As the diagram shows, industries with low barriers to switching tend to find a linear relationship between customer experience scores and revenue potential. Industries like airlines and wireless providers see great upside in fixing bad customer experience but then hit diminishing returns on higher customer experience scores.

Forrester observes an exponential relationship between customer experience and revenue potential in the industries with the combination of high barriers to switching, high relationship value, and high recommendation effectiveness. This finding should give multifamily operators pause as they consider the investments that they make to improve resident and prospect experiences.

As we argue in our new white paper, it is particularly relevant to smart building technology. Great, technology-enabled access control, for example, has a clear impact on living experiences, as prospects can tour and residents can organize their lives in a vastly more streamlined way. The improved experience can impact not only the price point at which a resident will lease or renew but also the likelihood that they will advocate for their community. Or, to put it another way, the better the experience, the greater the revenue upside.

Operators considering underwriting smart building technology projects based on rent increases should carefully consider the experience that the technology delivers. It is one thing to underwrite based on a predicted revenue outcome, but another to secure the rent increase. With access control so central to customer experience, the design of that experience will profoundly impact financial performance, as we discuss extensively in the white paper.

We welcome more research and analytical rigor in this increasingly important area, and I look forward to learning more about the J Turner and RealPage research at this Wednesday's launch webinar.

Photo by Uriel Mont from Pexels