Why You Shouldn’t (Over)Invest in Customer Experience

by Donald Davidoff | Mar 30, 2018 12:00:00 AM

Recently I’ve been spending time thinking about Customer Experience, and specifically how the industry talks more about the importance of the customer than it used to, but often makes at best marginal investments. As I pondered the reasons for this, I remembered a white paper Forrester released in early 2017 that had some very interesting analysis.

In the paper, Forrester describes how they analyzed 13 industries to understand the relationship between Customer Experience (CX) and revenue potential. They used their own proprietary CX Index and compared that to the revenue potential, based on a combination of retention loyalty, enrichment loyalty, and advocacy loyalty[1].

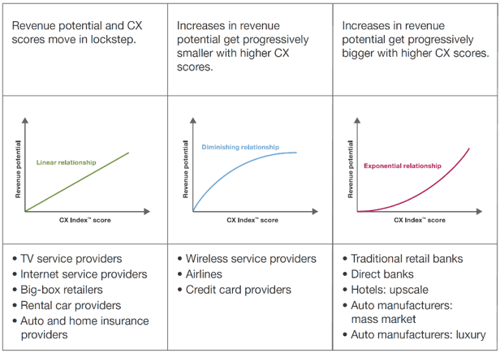

Forrester discovered that industries do not all derive value from CX the same way. In fact, they found 3 distinctly different archetypes:

Source: Drive Revenue with Great Customer Service, Forrester, Jan 18, 2017

In some businesses, the revenue potential moves up roughly equally for each improvement in CX. For others, there’s a large lift for getting away from the bottom end the spectrum, but progressively less return for achieving a high level of excellence. Then there’s a third group that doesn’t get rewarded much for being a bit “less bad” than the competition but will get high levels of return for great CX.

Big box retailers strike me as the most obvious in the first group. Think Kohl’s vs Kmart and then Nordstrom vs Kohl’s. Airlines are the classic example of the second archetype. From my own personal experience, I’ll pay more for a mainline carrier compared to the ultra-low-cost providers, but I don’t see myself paying a lot more if there was a truly deluxe airline flying the same route (particularly domestic routes). Lastly, upscale hotels represent the third group. Four Seasons, Ritz-Carlton, etc. get tremendously higher average rate (and lifetime customer revenue) than a Sheraton which in turn gets only modestly higher rates than a Courtyard or Hilton Garden Inn, etc.

So how does this relate to what level of investment MFH operators should (and do) make in CX? First, we have to ask ourselves in which group we belong. I would strongly advocate that we fall squarely in the middle group, the one that is more like airlines than anything else. This is driven by several observations:

- MFH operators have more opportunities to disappoint their customers than to “wow” them.

- Given the hassles and costs of moving, controllable retention is more about avoiding reasons for resident defection than giving explicit reasons to stay.

- There are limited upsell opportunities, so revenue enrichment is not a big driver for return on CX.

- Given the generally negative public view of “landlords,” there’s more opportunity for advocacy value from avoiding the negative word of mouth that from explicit positive advocacy.

Please note this doesn’t mean there’s no opportunity to “wow” residents, no opportunity to give them positive reasons to renew and/or no value in creating positive word of mouth. There clearly is. However, I believe there’s a diminishing return in this business as you walk up the CX curve.

In other words, there’s a “Goldilocks zone” (not too good, not too bad) where the return on investment in CX pays off the most. And that’s most likely why many operators go so far, and no further, when it comes to investing in CX. It’s why investing in pricing, sales performance improvement and business intelligence often crowds out opportunities to invest in CX. We’re running 95-ish occupancies with 2.5ish rent growth, so things feel “good enough.”

That’s why, as the title to this blog indicates, I think it’s quite rational to make sure we don’t invest too much in Customer Experience. That said, it doesn’t mean we shouldn’t invest anything. In particular, consider the following:

- We all need to be aware of a phenomenon Fjord Accenture has termed “liquid expectations.” Liquid expectations describe the growing tendency of customer expectations to seep from one industry into an entirely different industry. Consider that consumers increasingly compare how the airline industry manages the notification of a cancellation or schedule change to how Amazon handles shipping notifications or how prospects compare the experience of visiting your website to requesting a car from Uber. As experiences from one industry, previously thought to be unrelated, increasingly affect customer expectations elsewhere, we must raise our game or our prospects and residents will experience dissatisfaction in ways we haven’t previously needed to worry about.

- If you have a good Lead-to-lease platform (i.e. your pricing, sales and data platform is strong), then CX is the next step to continually improving performance. The key is make strategic, purposeful and measured investments into CX.

- While moving CX from good to great may not have as large a return as going from poor to good, it still has a return. And every $1 of NOI increase is at least $16 of value creation at today’s cap rates (more like $20 in many cases).

So, there you have it. That’s why I believe the industry doesn’t invest much in CX…and also some reasons that maybe it should invest (just a little) more. What do you think? We’d love to hear back from you.

[1] Retention loyalty value comes from customers continuing to spend; enrichment loyalty value comes from customers spending more; Advocacy loyalty value comes from customers spreading word of mouth