Why Short and Long-Term Priorities Aren't the Same for Multifamily Leaders

by Dom Beveridge | Mar 27, 2019 12:00:00 AM

After a decade of unprecedented growth, the multifamily cycle is hard to predict, as each new year of growth moves us further beyond historical norms. Our industry has lately acquired the habit of starting each year wondering if this will be the one where the bull run comes to an end. When we interviewed 20 executives at the end of 2018 for our 20 for ’20 white paper, we were keen to understand they saw the next few years and how that impacted their priorities.

After a decade of unprecedented growth, the multifamily cycle is hard to predict, as each new year of growth moves us further beyond historical norms. Our industry has lately acquired the habit of starting each year wondering if this will be the one where the bull run comes to an end. When we interviewed 20 executives at the end of 2018 for our 20 for ’20 white paper, we were keen to understand they saw the next few years and how that impacted their priorities.

First, the outlook

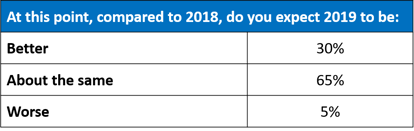

To keep things simple, we asked our respondents how they expected 2019 to compare to 2018 in terms of overall business performance. As the table below shows, a substantial majority of respondents expected 2019 to be the same as 2018 with almost a third expecting it to be better and very few expecting a decline.

The more cautious respondents noted that finding value, particularly for value-add projects, will continue to be challenging in 2019. Management fee compression was also a concern for fee managers, particularly since the cost of doing business has been going up, primarily due to increasing competition for talent (a subject that we will return to shortly on this blog).

Overall, in listening to the responses we noticed a consistent, cautiously optimistic logic that accompanied the scores. Respondents viewed supply and demand as being largely aligned in our industry, with the underlying fundamentals of the economy not at this point suggesting a downturn in demand for 2019. In an unpredictable world, these sounded like conditions that lend themselves to planning.

What does it mean for priorities?

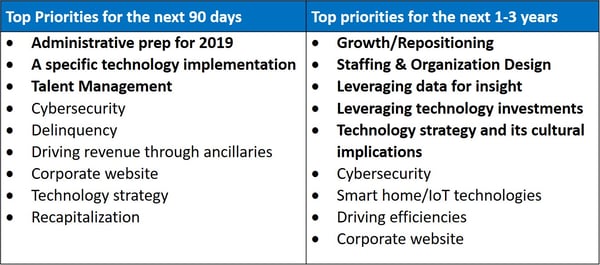

In approaching this research, we were curious about the nature of priorities. We asked the question in two different time frames: the next 90 days (from November 2018 onwards) and the next 1-3 years, thinking that the consistency or inconsistency of answers might provide some insight into the outlook for our industry and the way our executives prepare for it.

The responses to both questions are synthesized in the table below (we have interpreted the responses and, where appropriate, summarized into categories. Bold responses indicate multiple interviewees gave the same or similar answer and appear on the list in order of their popularity).

In reviewing the responses, we were struck by the variety of priorities that we received in both categories. There was some bias towards budget-related priorities and preparations for 2019, which is explained by the timing of the interviews, most of which took place in November.

The technology projects that featured in the 90-day priorities are also noteworthy. One of the most popular answers was that one particular technology implementation, typically a platform change or a new system roll-out, was the number one priority. As we discussed last week, for half of the companies interviewed, a single big project had dominated their IT activities in 2018.

The path to 2020 is all about GROWTH!

Based on the findings from our 20 executives, if priorities are indicative of company strategy, then there is a variety of ways in which companies are attempting to grow their businesses. This provides context to the question of what constitutes a priority for each of our operators. It also accounts for the absence of a dominant trend in their responses.

We were interested in the difference between the short and long-term priorities. After finishing 2018 the projects that interviewees discussed in explaining their answers were mostly to do with preparing their businesses for the next phase of growth. Several companies had repositioned portfolios and are preparing to execute on growth strategies in their selected markets. Cultural and training programs and the critical issue of staffing unsurprisingly attract high priorities.

Looking forward to 2020 and beyond, many of the priorities are associated with driving benefits from technology implementations. Not only has there been considerable investment in new technology platforms, but companies also appear to be committed to reaping the financial benefits.

For more on this research download “20 for ‘20” - our white paper that summarizes our interviews with 20 senior multifamily executives about the outlook to 2020 and beyond.