An Update on Rent Growth Numbers

by Donald Davidoff | Mar 16, 2017 12:00:00 AM

Just as I sent out an executive newsletter highlighting the rapid decline in new rent growth, out comes successive reports from Axiometrics that YOY rent growth was flat from December to January and actually rose for the first time in many months from January to February.

So what’s a consultant supposed to do whenever facts conspire against his best efforts to predict the world? I’m not sure, but here’s what I’m doing:

1. 'Fessing up to clearly missing what was going to happen in January and February

2. Digging a little more deeply into the numbers to see what sense can be made of this

There are definitely some “tailwinds” that help explain this surprise. Top on the list is job growth. Last month’s growth of 235,000 was much more than predicted and came on the heels of 227,00 net new jobs in January. Interest rates, though likely to rise, are still historically low, and the Trump administration seems to be giving confidence to Wall Street…at least for now.

At the same time, I’m not quite ready to say I was abjectly wrong, though I hope I will end up saying that in a few months 😊

Despite the good news, I still see some cause for at least caution and maybe even concern. For starters, the decline in YOY growth began in October 2015. January through April 2016 gave us some reprieve only to be followed by strong YOY declines in the high season; so IMO, the jury is still out on whether this is the start of a very soft landing or just a pause before bigger changes in YOY growth come the summer.

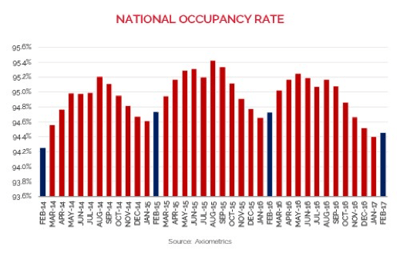

Of more concern, we should take a look at the occupancy numbers from the same Axiometrics report:

While rents are up a bit more YOY in February than in January, occupancy is still down 27bps YOY. That indicates that the extra bump in rent comes at the expense of occupancy and is roughly a wash on revenue per unit (RPU). If occupancy continues to lag in 2017, that will put some additional pressure on rents, likely resulting in lower growth.

The bottom line is that, while the January and February numbers are a source of comfort, we’re far from the “all clear” sign. Based on the patterns from last spring, we’re not likely to be sure anything (if we ever are) until summer. Meanwhile, focusing on the demand management platform will continue to be an insurance policy should things go south again…with the added benefit that such a focus will be equally useful to maximize the benefits should rent growth sustain.